Why Is It Hard To Time The Market?

HDB Prices From 2008 to 2023

Source: 99.co & URA

Private Property Prices From 2008 to 2023

Source: 99.co & URA

Does This Sound Familiar To You? Prices Are High Now, Let’s Wait For The Price To Drop Before Entering The Market.

There is nothing wrong with this thought. But here’s the truth which no one shared with you & before you could realise, you are already priced out from the market.

Scroll down for our analysis …

Before we begin, just an introduction about myself (Colelyn) & Tracy. We have been in the real estate industry for over 14 years and have helped many clients to upgrade and re-size their homes. But the sad truth is, we have seen many with the misconception of buying a place without proper research, rushing to fully pay their property ended up stuck in huge negative sales. And when it comes to their retirement thinking that they are able to cash out some money for monthly expenses, they ended up in despair as they were not aware on this problem.

1st Reason: Rising Land & Construction Cost

Source: PropNex Research, URA (*enbloc sales)

As we all know, Singapore is a country where land is scarce. It’s not a surprise that land cost will just be higher and higher because we do not have an abundance of land as compared to neighbouring country.

Also, with the recent pandemic, raw materials and labour cost have gone up as seen in the above chart. Adding both the land pricing and construction cost, it will naturally push up the prices not just in today’s market but also in the future.

Hence, for buyers who are sitting on the fence, waiting for prices to drop, is it really possible to time the market?

2nd Reason: Property Prices Are Suppressed By Cooling Measures & Rising Interest Rates

With the many rounds of cooling measures since 2013 implementing not just on Additional Buyer Stamp Duty (ABSD) but also MAS regulations on housing loans like Loan To Value (LTV), Total Debt Servicing Ratio (TDSR) and the recent ABSD raise, our government is definitely on a tight watch to ensure that property prices remains affordable and a steady increment rather than a sharp rise.

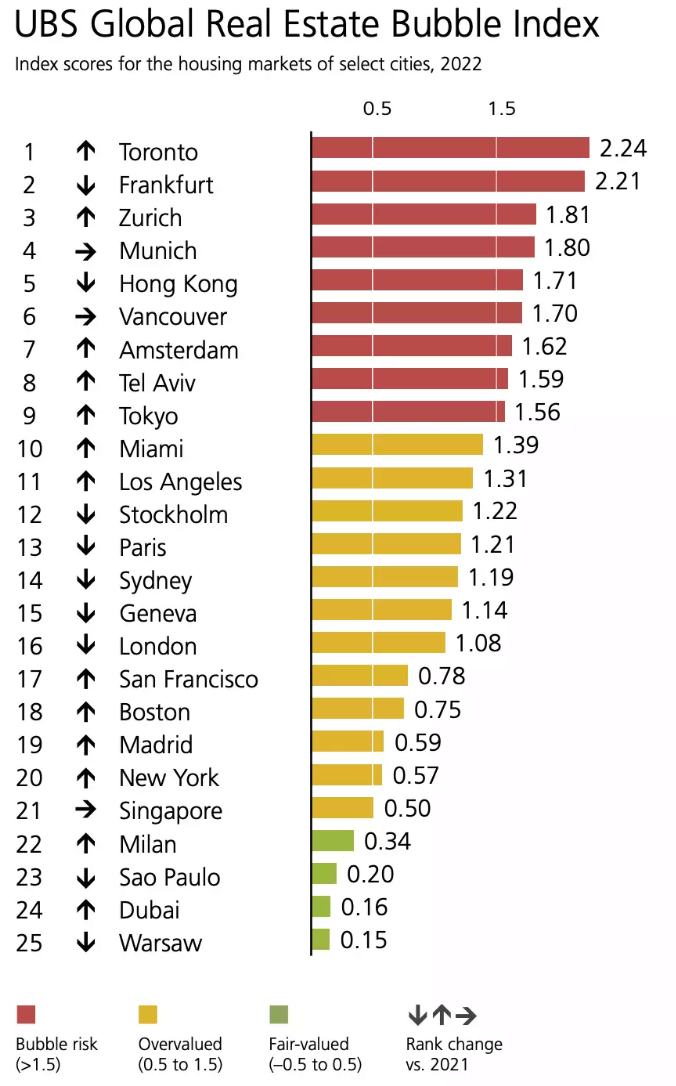

That is also a reason why Singapore Property remains low on the bubble index as compared to other countries in the world as seen below.

Source: https://www.ubs.com

On our next chart, you will see that the current property prices are actually suppressed with the interest rates. Based on the past history, each time the interest went down, the property prices went up. We can only come out with this analogy that when the interest rate goes down, buyers actually rush in to buy. When supply is constant, demand goes up… it means prices will go up naturally.

Source: PropNex Research, URA, ABS

As we deep dive into The Federal Reserve interest rates, this might be a small window of opportunity left for buyers who are waiting for prices because there are signs of pausing through articles and also slower increment as seen from the curve below.

3rd Reason: Demand Vs Supply

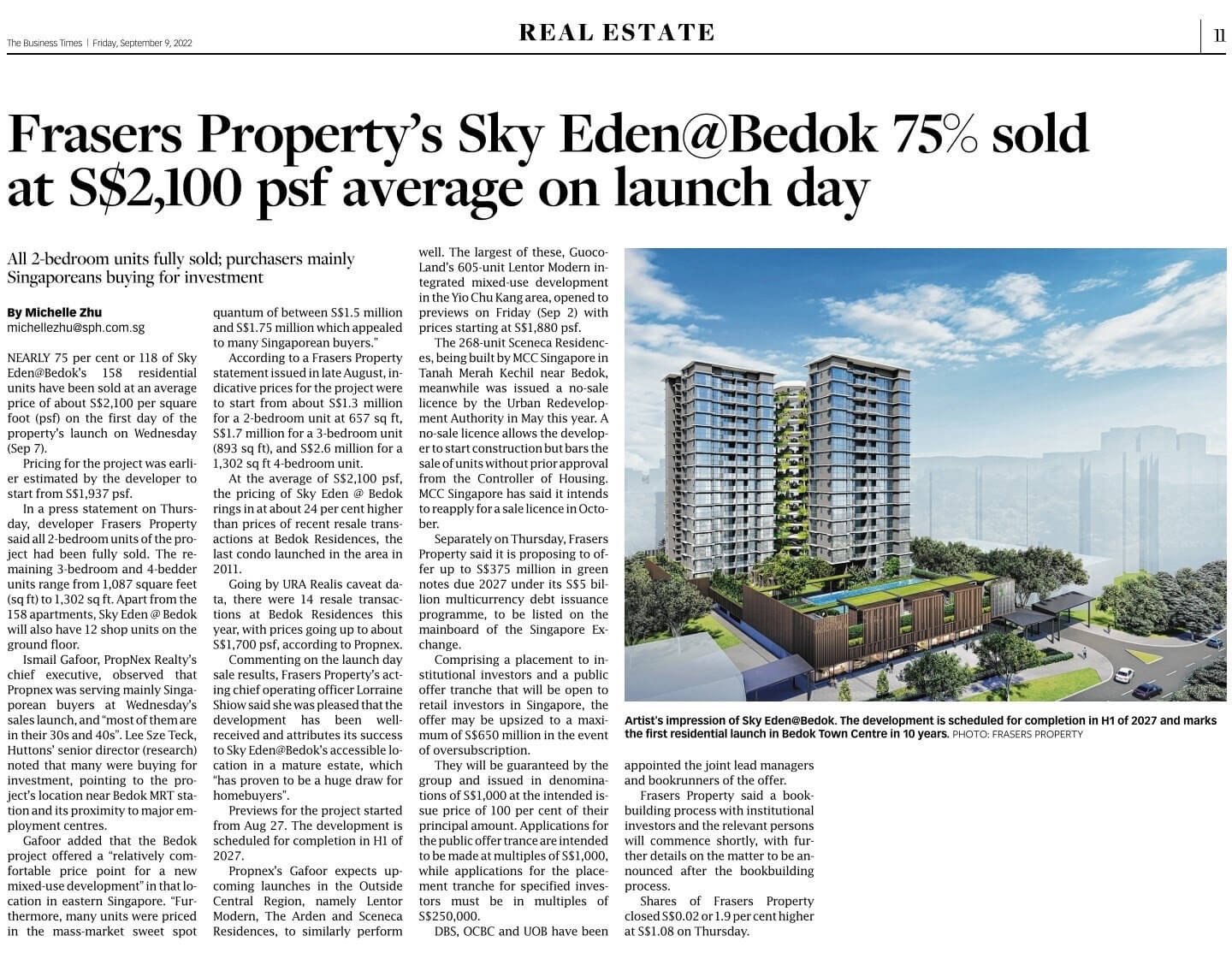

In fact Property in Singapore is all about demand and supply. As we see quarter by quarter since 2021 till now, this is the lowest supply we have seen thus far. The supply is not sufficient to catch up with the demand. Property prices are not just based on 1 factor alone but multiple factors.

To sum up, land cost and construction cost would not be coming down not just base on the pandemic or land scarcity. which means that builders and developers have to charge more for new properties to cover their costs. There is also inflation which drives up cost of living.

Property prices are indeed high right now, but can you imagine if our government did not put in place rounds of cooling measure and tightening of loans, what would be the property prices now?

That is also one reason why during the recent pandemic there wasn’t much fire sales in the market as the measures were able to weather such uncertainty as compared to the past.

Thousands Of People Are Still Buying Despite The High Prices Now…

Is There Something Which Others Know & You Don’t?

After Reading Our Analysis, You Might Be Thinking:

What Should Be Your Next Step?

Should You Sell & Upgrade Now?

Should You Be Buying A HDB or Private Property?

Are You Priced Out From The Property Market?